What TARI Is All About

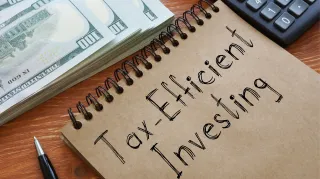

The Tax-Advantaged Retirement Institute (TARI) was created with a clear mission: to help high-net-worth individuals protect and grow their retirement wealth through strategic, tax-efficient planning.

In a financial landscape where tax laws are constantly evolving and often complex, even the most successful professionals and entrepreneurs can miss key opportunities to minimize their tax burden. That’s where TARI comes in.

At its core, TARI is more than just a resource;

it's an advocate for common-sense tax policy and a guide for individuals who want to make the most of what they’ve earned. Whether you’re nearing retirement or already enjoying it, we provide the education, strategies, and expert insights you need to make informed decisions that preserve your wealth and secure your financial legacy.

Our platform is designed specifically for those who understand the value of planning ahead. TARI offers ongoing updates, tools, and personalized content to help you stay ahead of the curve. From decoding tax legislation to recommending proactive steps for managing your assets, we’re here to ensure your money works smarter not just harder for you in retirement.

If you’ve worked your entire life to build something meaningful,

it’s time to make sure you can keep it.

That’s the TARI promise.

What Are Tax Retirement Strategies?

When most people think about retirement planning, they focus on how to save enough. But just as important and often overlooked is how to keep what you've saved. That’s where tax retirement strategies come in.

Tax retirement strategies are intelligent, forward-thinking approaches that reduce the amount of income lost to taxes during retirement. For high-net-worth individuals, who often face higher tax brackets and more complex financial portfolios, these strategies can make a substantial difference.

The goal is simple:

maximize after-tax income and preserve wealth for the long haul.

This can involve a variety of techniques:

1. Timing Social Security benefits strategically to reduce taxable income

2. Roth conversions that allow for tax-free withdrawals later

3. Tax-efficient withdrawal sequencing, choosing which accounts to draw from first

4. Leveraging tax-advantaged accounts like Roth IRAs or Health Savings Accounts (HSAs)

5. Charitable giving strategies that provide both personal fulfillment and tax benefits

Individually, each strategy can offer savings. But when applied together as part of a well-coordinated plan, they can dramatically reduce lifetime tax liability and help you pass on more to the next generation.

TARI exists to bring these strategies to life making them understandable, actionable, and aligned with your goals. Many professionals don’t know these options exist or assume they don’t apply to them. We’re here to change that. With expert-led insights, real-life examples, and practical guidance, TARI helps you create a tax-smart retirement plan that supports both your lifestyle and legacy.

Recent Articles

What’s the Most Tax-Efficient Retirement Withdrawal Strategy?

Withdraw retirement funds wisely: start with non-retirement assets taxed at ordinary income, then long-term gains investments, followed by traditional IRAs, Roth IRAs, and lastly non-qualified annuiti... ...more

Recent Articles

July 07, 2025•2 min read

How to Avoid Taxes When Gifting a Beneficiary

Want to give back without triggering gift taxes? Learn smart strategies like gifting within limits, donating stock, paying medical/tuition bills directly, and spreading gifts over years—so more goes t... ...more

Recent Articles

July 07, 2025•2 min read

What is a Life Insurance Retirement Plan (LIRP) and Why Do You Need One?

New Blog Post Description ...more

Recent Articles

July 07, 2025•3 min read

Do Your Contributions Exceed Tax-Qualified Retirement Plan Limits? Here’s What You Should Do

New Blog Post Description ...more

Recent Articles

July 07, 2025•2 min read

One Simple Step That Lowers Your Retirement Fund Fees

The Problem with Retirement Planning: Fees, Fees, and More Fees ...more

Recent Articles

July 07, 2025•2 min read

What is Tax Loss Harvesting And Why Do You Need to Do it?

We’ve all sat there looking at a losing trade wondering what we should do. After all, we don’t want to take a loss. However, there is a smart way that you can turn that investment loss into a win. It’... ...more

Recent Articles

July 07, 2025•2 min read

Upcoming Events

17

SEP

Roadmap to Become a Certified Professional Coach

8:00 am - 5:00 pm Vancouver, Canada

28

SEP

Finding a Job of Your Dreams is Easy!

8:00 am - 5:00 pm Vancouver, Canada

12

OCT

The Importance of Giving in Order to Start Receiving

8:00 am - 5:00 pm Vancouver, Canada

02

NOV

The Biggest Differences Between an Introvert and Narcissist

8:00 am - 5:00 pm Vancouver, Canada