Why 70% of Financial Plans Fail

WELCOME TARI MEMBERS

The Tax-Advantaged Retirement Institute (TARI) is a public policy think tank dedicated to making your retirement more profitable.

Our events provide our members with insights into cutting-edge financial strategies designed to keep Uncle Sam out of your retirement, LEGALLY!

Membership is 100% free; all we ask is that you invite friends, family, and colleagues to join us at our next event to help us better protect the wealth you have all worked long and hard for.

Do 70% of Financial Plans Really Fail?

YES!

This alarming statistic represents billions in mismanaged retirement funds and countless business leaders working years longer than necessary.

Why Do Most Financial Plans Fail?

The conventional wisdom suggests financial plans fail because of:

- Bad investment strategy or advice

While some advisors provide subpar guidance, even excellent strategies often go unimplemented.

- Getting started too late

Starting early helps, but many who begin planning decades ahead still fail to secure their retirement.

- Economic conditions

Market volatility impacts returns, but well-structured plans should withstand economic cycles.

These are not the primary reasons financial plans fail.

Studies show that at least 70% of financial planning recommendations aren't implemented. (Source: "Why Most Financial Plans Fail," Forbes article by Tim Maurer, September 12, 2021)

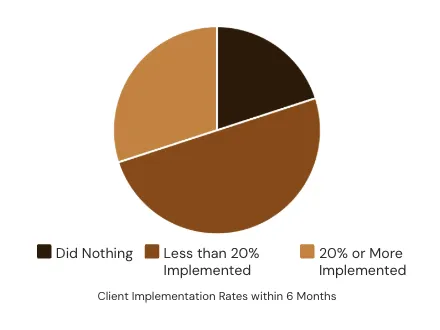

In a survey of 138 financial advisors who provide plans for a fee, on average, only 30% of their clients implemented 20% or more of the recommendations within six months. About half implemented less than 20%, and nearly a fifth did nothing. (Source: "Where Formal Financial Plans Fail," article by Russ Alan Prince, December 2, 2019)

In a separate study of 83 successful entrepreneurs who paid between $6,200 and $38,600 for formal financial plans, only about a quarter implemented three or more recommendations within a year. (Source: "Where Formal Financial Plans Fail," article by Russ Alan Prince, December 2, 2019)

This implementation gap is costing business owners millions in potential retirement assets and years of unnecessary work.

Here's the Data:

The Implementation Gap

Unique Retirement Challenges for Business Owners and Leaders

1. Overconcentration of Wealth

Many business owners have too much tied up in their company, leaving retirement vulnerable to market shifts, inflation, or unexpected health issues that could force an early exit.

Source: "5 Essential Retirement Steps for Business Owners," Avior Wealth Management, April 8, 2025

2. Delayed Retirement Due to Insufficient Savings

Older business owners are increasingly postponing retirement because they worry about not having enough saved, often due to time spent building the business rather than personal planning.

Source: "Older Business Owners Are Delaying Their Retirements – and Need Advisors' Help," Nationwide, June 20, 2024

3. Emotional and Identity Shifts

Stepping away from your business can lead to a loss of purpose or identity, making it harder to transition—even if the finances are in place.

Source: "The Hidden Challenges of Business Owner Retirement," WH Cornerstone Investments

How Does This Happen?

Common Pitfalls in Traditional Financial Planning

Overwhelming Comprehensiveness

Formal plans are often so detailed and holistic—covering net-worth statements, cash-flow analyses, investment plans, risk management, and estate plans—that you may feel paralyzed by the volume of decisions and actions required. As a result, it's easy to end up doing nothing.

Source: "Where Formal Financial Plans Fail," article by Russ Alan Prince, December 2, 2019

Sales-Focused Experiences

Many plans feel like they're designed more to sell products like brokerage accounts, insurance, or banking services, which can create distrust and resistance, making it harder for you to follow through.

Source: "Why Most Financial Plans Fail," Forbes article by Tim Maurer, September 12, 2021

Prioritizing Tools Over Your Goals

Plans frequently emphasize technical solutions (e.g., 401(k) rollovers, Roth conversions, or asset allocation) rather than starting with your personal hopes, dreams, and immediate concerns, leaving you feeling unmotivated to act.

Source: "Why Most Financial Plans Fail," Forbes article by Tim Maurer, September 12, 2021

Psychological Barriers

As humans, we're wired for "hyperbolic discounting," meaning we naturally prioritize immediate needs over future benefits. This can make long-term retirement-focused plans feel like a chore rather than something exciting.

Source: "Why Most Financial Plans Fail," Forbes article by Tim Maurer, September 12, 2021

*Business Owner-Specific Challenges

Plans often fail when you have pressing immediate needs (like protecting business assets or addressing current tax concerns), high complexity in your financial life (making plans feel unwieldy), or limited time due to running a business and balancing family demands—leaving little bandwidth for big changes.

Source: "Where Formal Financial Plans Fail," article by Russ Alan Prince, December 2, 2019

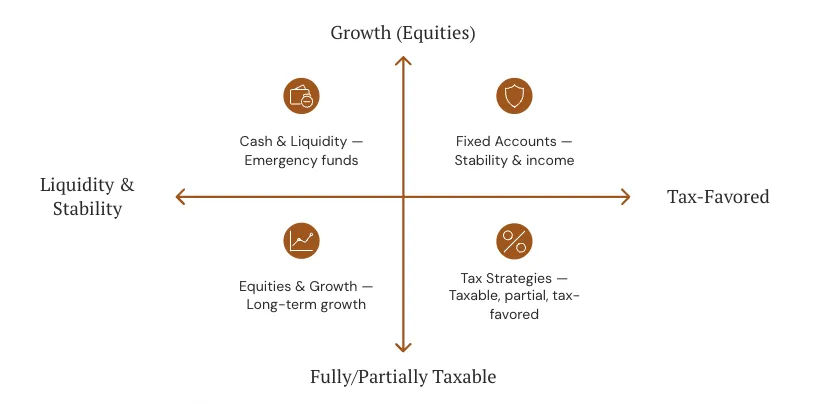

How Do We Fix It? The Retirement Matrix

A Comprehensive Approach to Protecting Your Wealth with Accelerated Implementation

Three Investment "Pots"

- Cash: For immediate liquidity needs and emergencies

- Fixed Accounts: Like bonds for stability and predictable income

- Equities: Stocks and mutual funds for long-term growth

Strategic Tax Locations

- Fully Taxable: Traditional retirement accounts

- Partially Taxable: Certain investment vehicles with tax advantages

- Tax-Favored: Roth IRAs, certain life insurance strategies

This method focuses on your objectives, risk tolerance, and time horizon to allocate assets properly, potentially allowing you to retire 5-10 years earlier without grinding through 60-80 hour weeks. We create customized planning that brings value to your life today—not just decades from now—with simple, actionable next steps that fit your busy schedule as a business leader.

Upcoming Events

17

SEP

Roadmap to Become a Certified Professional Coach

8:00 am - 5:00 pm Vancouver, Canada

28

SEP

Finding a Job of Your Dreams is Easy!

8:00 am - 5:00 pm Vancouver, Canada

02

NOV

The Biggest Differences Between an Introvert and Narcissist

8:00 am - 5:00 pm Vancouver, Canada